A rapidly growing business providing payment services to our customers

The Cryptocene Epoch

The world has entered a new era of money and value. The future depends on strong institutional foundations today.

Financial Services

We provide the rails to move money and a gateway to FX and crypto markets at scale, for businesses building the future of money.

Our Vision

To empower the global financial revolution through sustainable and innovative banking.

Focused Mission

We aspire to connect and bank the global crypto industry.

BCB BUSINESS ACCOUNTS

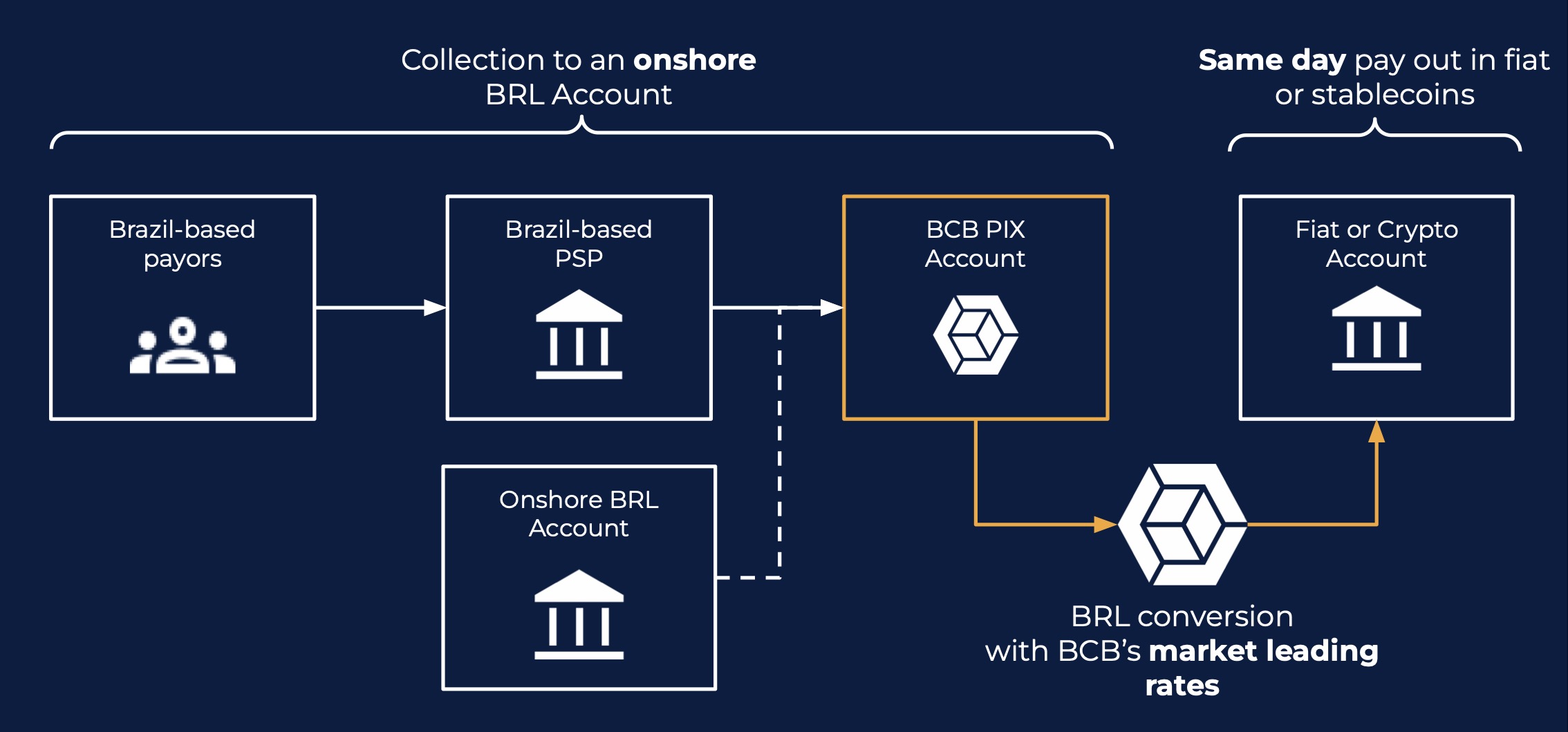

Multi-currency transaction payment solutions

Payment accounts in major world currencies with access to most local international payment rails; wallets in major cryptocurrencies, stablecoins and other digital assets.

BLINC

Move money instantly, 24/7/365, with no transaction fees and no limits

Global settlements network allowing members to pay each other across multiple currencies.

BCB CRYPTO

Trade any digital currency over the counter and securely store your digital assets

Buy and sell crypto at scale at highly competitive spreads

BCB FX

FX trading in dozens of currencies, with highly competitive institutional rates

BCB TREASURY

The first ‘all-in-one’ solution empowering corporate treasuries to include crypto assets

Buy, sell, store and manage your fiat and crypto treasury portfolio.

Featured News

Get in touch. Speak to one of our experts today.

BCB Business Accounts

Multi-currency business payment solutions